|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

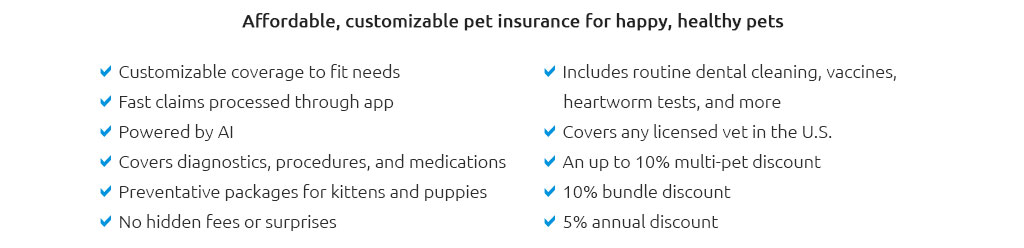

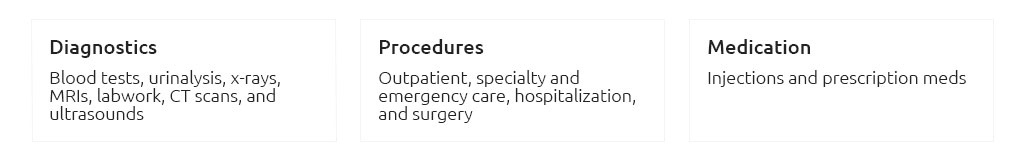

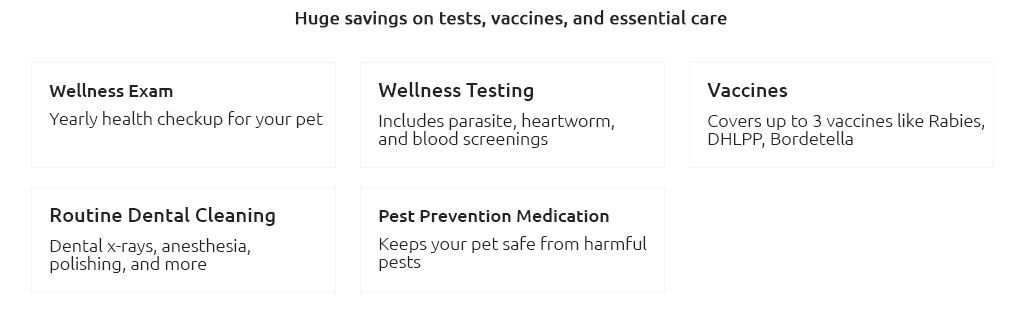

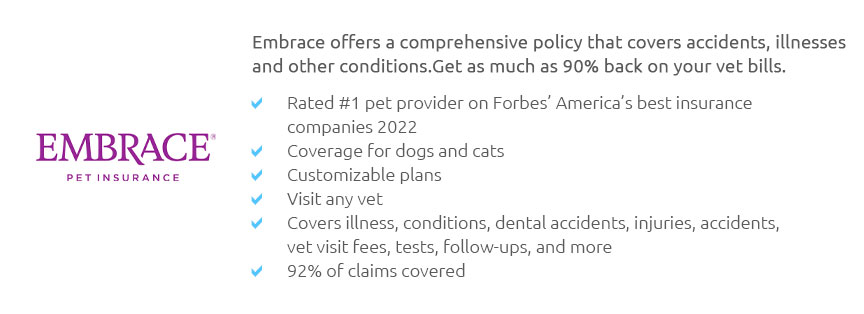

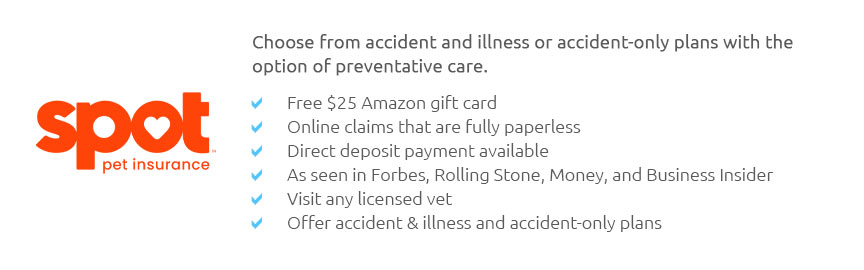

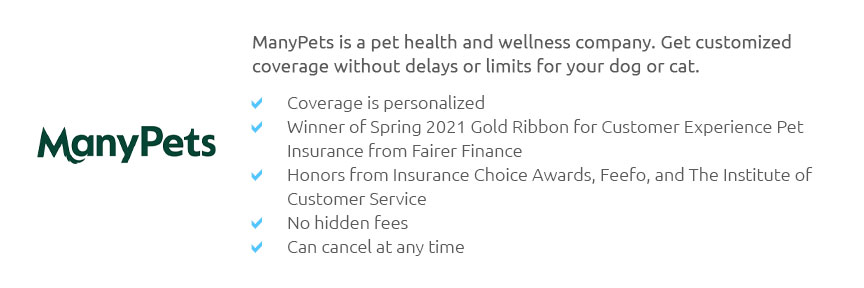

A Beginner's Guide to Pet Health Insurance for DogsAs a dog owner, you undoubtedly want the best for your canine companion, ensuring they lead a healthy and fulfilling life. Pet health insurance for dogs is a topic gaining traction among pet parents, yet it often leaves many feeling puzzled. This guide aims to unravel the complexities and highlight the nuances of selecting the right insurance for your furry friend. First and foremost, what exactly is pet health insurance? In essence, it operates similarly to human health insurance, covering a portion of your dog's medical expenses. These expenses can range from routine check-ups to more extensive procedures like surgeries or treatments for chronic conditions. The idea is to mitigate the financial burden that unexpected veterinary bills can impose, offering peace of mind and ensuring your pet receives the care they need without delay. When considering pet insurance, understanding the types of coverage available is crucial. Generally, policies fall into three categories: accident-only, accident and illness, and wellness plans. Accident-only policies cover injuries resulting from accidents, such as fractures or ingestion of foreign objects. Accident and illness policies offer broader coverage, including diseases and hereditary conditions, whereas wellness plans typically cover routine care like vaccinations and annual exams. Each type has its pros and cons, making it essential to assess your dog’s specific needs and your financial situation. One common question is, Is pet insurance worth it?' The answer isn't straightforward and depends on various factors, including your dog's breed, age, and existing health conditions. For breeds prone to genetic conditions, such as hip dysplasia in German Shepherds, insurance can be particularly beneficial. Moreover, the cost of veterinary care is rising, making insurance an attractive option for those who prefer predictable budgeting over unexpected expenses. Another consideration is the cost of the premiums. Prices can vary widely based on the coverage level, your dog's age, breed, and even your location. Shopping around and comparing policies is advisable to ensure you get the best deal. Some providers offer customizable plans, allowing you to adjust deductibles and reimbursement levels to suit your budget. Additionally, some insurers provide discounts for insuring multiple pets or for paying annually rather than monthly. When evaluating insurance providers, pay attention to exclusions and limitations. Many policies exclude pre-existing conditions, which are any illnesses or injuries your pet had before the start of the policy. Therefore, enrolling your pet at a young age can be advantageous. Also, some policies have annual, per-incident, or lifetime caps on payouts, so it's vital to read the fine print and understand these limitations before committing. Moreover, consider the claim process and customer service reputation of the insurer. A company with a streamlined claim process and excellent customer service can make a significant difference in your experience. Reading reviews and seeking recommendations from other pet owners or your veterinarian can provide valuable insights. Lastly, while pet health insurance can offer financial relief and peace of mind, it's not a one-size-fits-all solution. Some pet owners prefer to set aside savings for potential veterinary costs, while others feel more comfortable with the safety net insurance provides. Ultimately, the decision should align with your financial situation, risk tolerance, and your pet's needs. In conclusion, pet health insurance for dogs is a valuable tool for managing your pet's health expenses. By researching thoroughly and selecting a plan that fits your lifestyle and financial situation, you can ensure that your beloved dog receives the care they deserve, come what may. As you embark on this journey, remember that the goal is to safeguard your pet's well-being, allowing you to enjoy many happy years together. https://www.akcpetinsurance.com/

AKC Pet Insurance offers pet insurance to both cats and dogs of all ages and breeds. Get a free quote from our calculator today or call us at 866-725-2747. https://www.usaa.com/insurance/additional/pet

Pet insurance is a policy that helps give peace of mind to pet owners. If your furry family member needs an exam, procedure or medication because they're ... https://www.petinsurance.com/dog-insurance/

Having pet insurance for your dog isn't just about covering costsit's about peace of mind. When your dog needs medical attention, the last thing you want to ...

|